s a manager, you probably know the ins and outs of your department like the back of your hand. And while you’re likely no stranger to working with budgets on a frequent basis, many managers don’t get the opportunity to receive in-depth training on the various ways financial habits impact an organization’s long-term success.

Budgets may seem like nothing more than a guideline for spending, but they are actually one of the biggest factors in identifying the health of an organization. As a leader, you play an essential role in these efforts because you know your department best.

University of Utah Health’s central finance team has introduced an easy-to-use management reporting tool called Strata, to help support you in this process. Strata creates a digital link between you and our central finance team. This helps us partner with you to better understand how we can help improve the financial health of your department.

Don’t worry—we don’t expect you to become a financial whiz. Rather, we hope to leverage your expertise and work together to bring clarity to the organization’s overall finances. This article discusses the importance of financial reporting and shares a few best practices to help make management reporting a little easier.

Step-by-Step Tutorial

Visit us on Pulse for a step-by-step tutorial on all things Management Reporting.

What is Management Reporting?

Strata Management Reporting is a computer program that helps managers track and report financial variances in spending month-to-month.

Every month, your department’s financial results will be entered into the Strata system and compared against the prior month’s budget. The results will be broken down into metrics grouped within different categories that parallel budgeting.

You will receive an email that notifies you when your targets exceed or do not meet the threshold, or predetermined budget. Once you log in, you will be able to review and comment on these variances.

Additionally, you can use Strata’s interactive dashboard to monitor fluctuations in your financial results over the course of 13 months.

Essentially, this management reporting system will help us understand the story behind the data points—or why certain variances occur. Are these changes something that we can fix or help with, or was the adjustment something out of our control?

What is the value of Management Reporting?

So why is management reporting so important? Overall, it helps managers understand the differences between expectations (or the budget) and reality (or Last Month Actuals). Managers can better assess the key areas in their department in a meaningful and measurable way.

Reporting these variances allows us to acknowledge the areas that are doing well and identify the areas where we have room for improvement. Not only will we be better at spotting those benefits and risks down the road, but we’ll also gain a deeper understanding of how to create the best path moving forward.

Ultimately, management reporting helps you become a better leader. It gives you the chance to understand your department’s operations a little more. It’s an opportunity to learn how you can elevate your department to become even more successful. And your ongoing support and feedback makes it possible for us to help University of Utah Health continue to thrive.

More Resources

Read the Harvard Business Review's "6 Ways Understanding Finance Can Help You Excel Professionally."

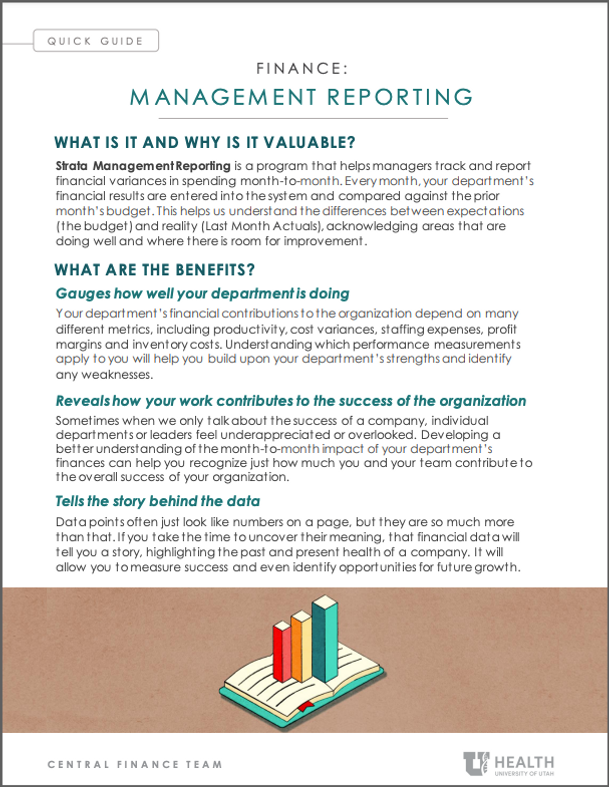

3 Benefits to Understanding Finance

1. Gauges how well your department is doing

Every department is unique in the ways it contributes to the overall success of our organization. Sometimes we judge our value based solely on how much revenue we generate, but financial health depends on multiple factors.

Your department’s financial contributions to the organization depend on many different metrics, including productivity, cost variances, staffing expenses, profit margins and inventory costs. Understanding which performance measurements apply to you will help you build upon your department’s strengths and identify any weaknesses. Our central finance team can help walk you through this.

2. Reveals how your work contributes to the success of the organization

It’s easy to feel like a small fish in a big pond in an organization as large as University of Utah Health. Sometimes, when we only talk about the success of the overall organization, individual departments or leaders feel underappreciated or overlooked.

Developing a better understanding of the month-to-month impact of your department’s finances can help you recognize just how much you and your team contribute to the overall success of our organization.

On a personal level, deeper financial knowledge may help you to negotiate raises, additional FTEs, or other benefits for yourself or your department down the line.

3. Tells the story behind the data

Data points often just look like numbers on a page, but they are so much more than that. If you take the time to uncover their meaning, the financial data will tell you a story.

Data highlights the past and present health of a company and can even predict its future success. Owners, competitors and potential investors rely on that information to analyze an organization’s reputation, measure its success and identify growth opportunities.

Management Reporting Quick Guide

Download the Management Reporting Quick Guide to learn the basics and easily reference the step-by-step process.

Step-by-step process to management reporting

Management reporting entails three main steps to carry out the process. Although it’s possible to get bogged down in the details, by following the step-by-step process below you will be able to efficiently and successfully review and complete your reports:

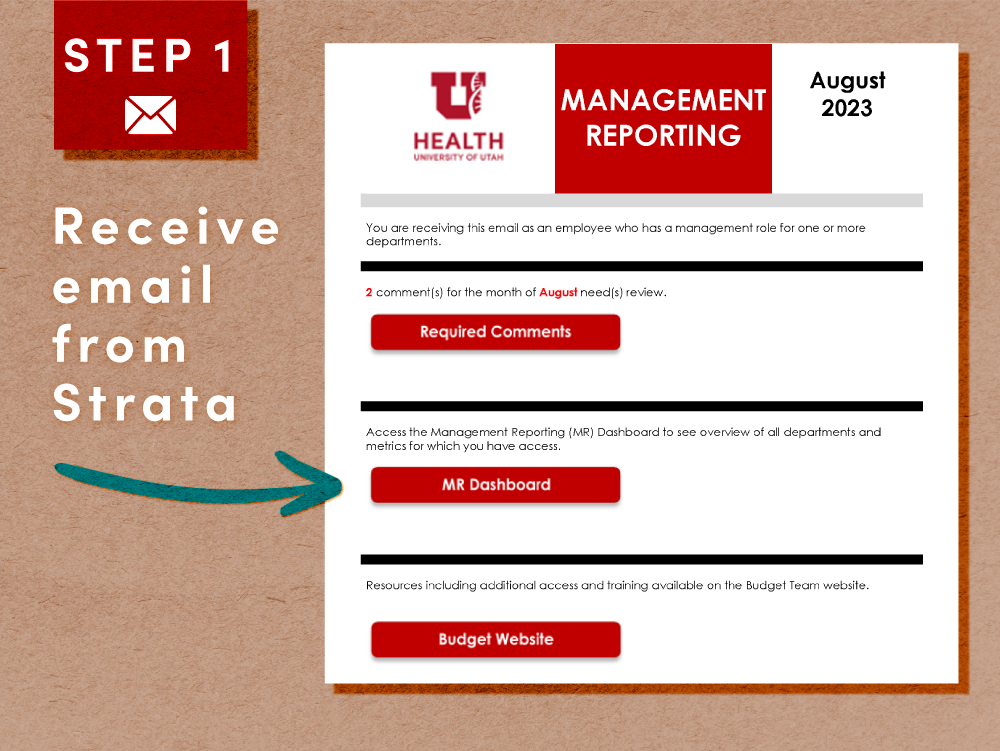

Read the email to see what percent of your metrics met their variance threshold and how many metrics need comments added for explanation.

*Your finance director is listed at the bottom of the email in case you need to reach out for help.

Review the dashboard to see the following details: your departments requiring a metric, the metrics not meeting their threshold (i.e. have a variance), and the individual metric details. Drill down into the details to research the variance and better understand why it exists.

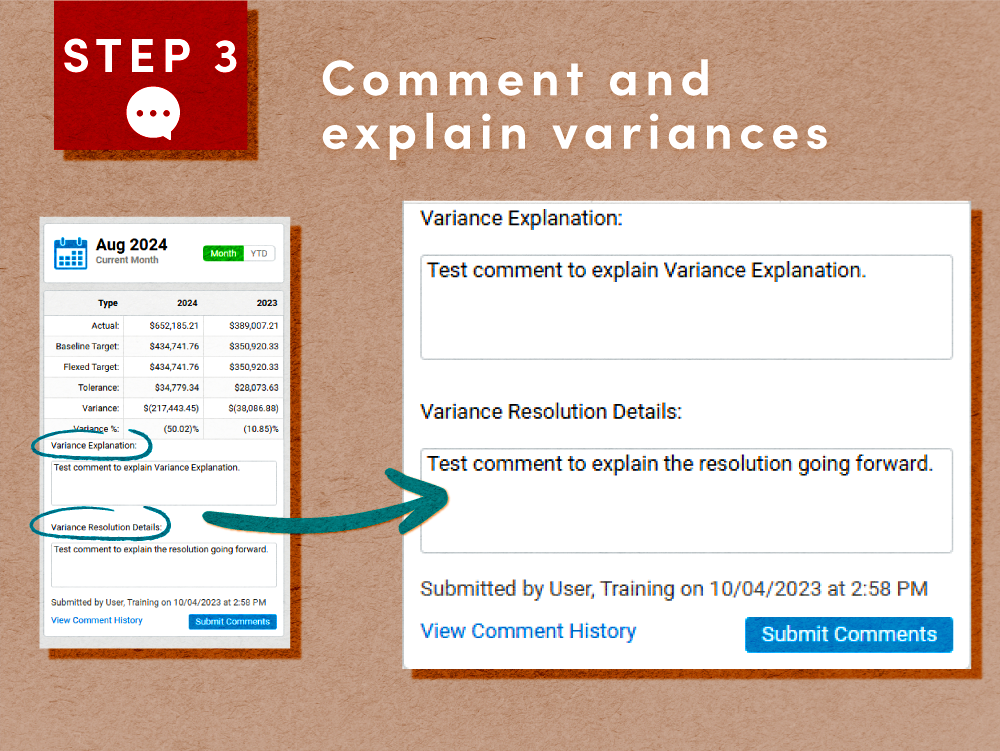

Explain the variance and what will happen to prevent it moving forward. If the variance is likely to continue, contact your finance director for help.

Casey Moore

Robert Dickson

Understanding financial reports is crucial for leaders making informed decisions for their teams and departments. Finance leaders Clint Reid, Casey Moore, and Robert Dickson walk us through some of the most common reports that leaders can utilize in operations and strategy.

The annual Operating Budget is a structured process that pairs frontline manager expertise with powerful financial forecasting tools to help the organization stay on track. The Central Finance Team’s Casey Moore and Robert Dickson demystify the process to help you navigate budget season.

Finance can provoke anxiety among professionals, many of whom were never trained in finance, yet now find themselves responsible for contributing to the overall financial well-being of our system. Finance leaders Casey Moore and Clint Reid offer a basic vocabulary to help establish a shared financial language at University of Utah Health.