What is the Operating Budget?

we return from the most wonderful time of the year, it’s time to start planning for a different kind of season – the annual budget season. Although the spring deadline may feel far away, we hope these financial tools will help our leaders get a head start with the ins and outs of the operating budgeting.

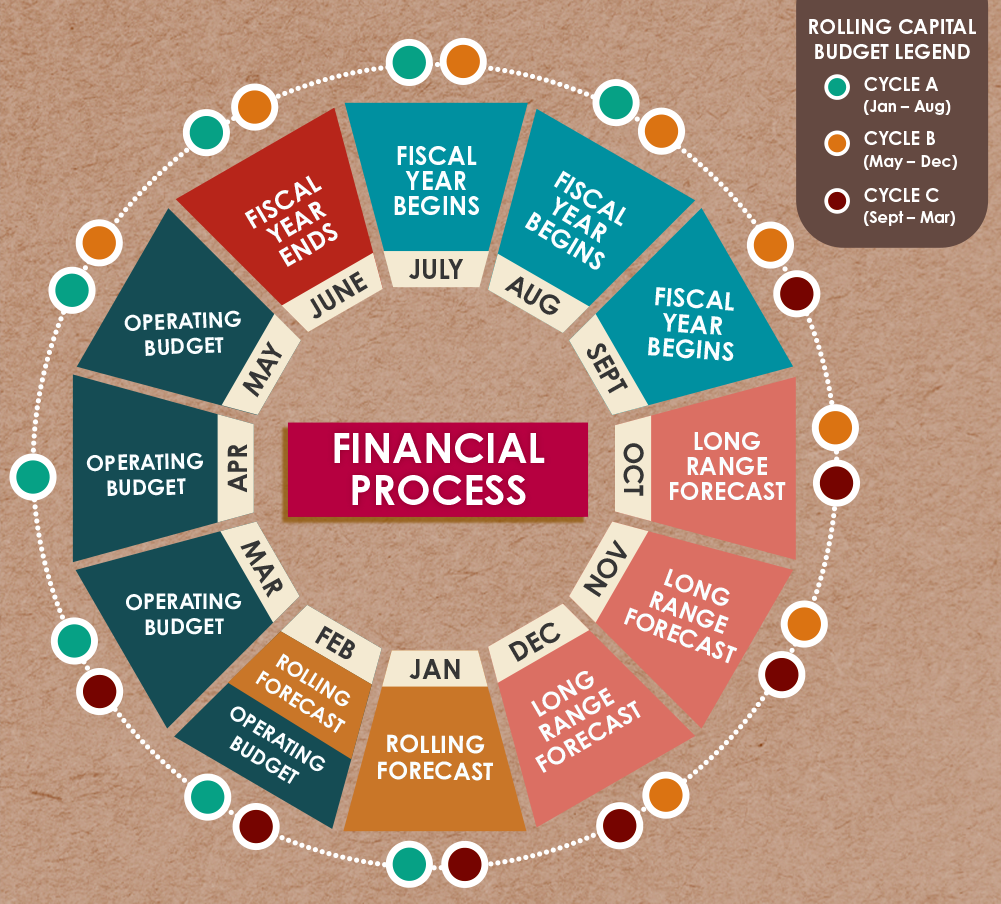

The operating budget is the annual financial forecasting process conducted each spring where we identify expected revenue and expenses for the next fiscal year. Having a structured process helps us consider the long-term financial needs of our organization, stay on track with current priorities and goals like the Financial Action Plan, and manage unexpected expenses along the way. It is a critical step in our larger annual financial process.

Who is involved in the Operating Budget process?

Though every employee impacts the operating budget, department managers and those in financial leadership roles are heavily engaged in the budgeting process. At U of U Health, we put control of expenses in the hands of the experts who are closest to where the work is done – our managers. Using a program called Strata, our Central Finance Team helps leaders formulate their individual budgets. With guidance and support, we hope to set our managers up for success this budget season.

A Five-Step Process

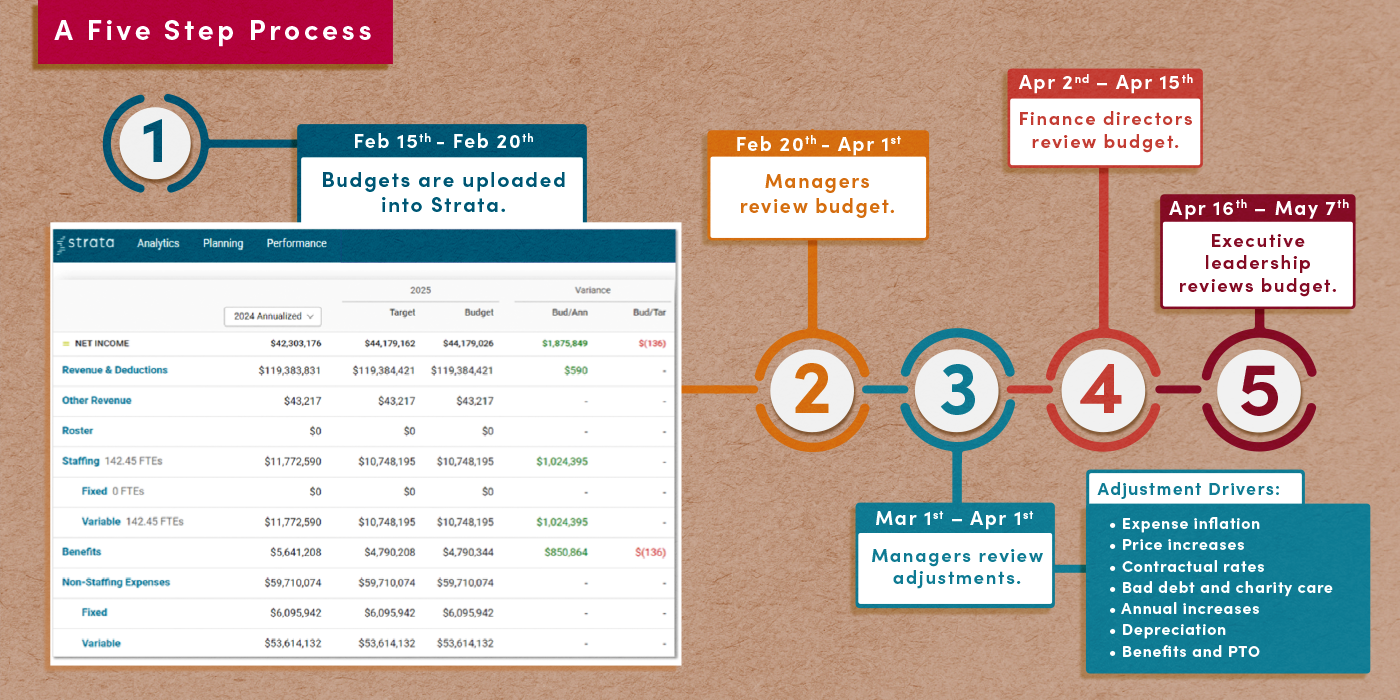

This year, Strata One Plan technology will support the operating budget's five-step process.

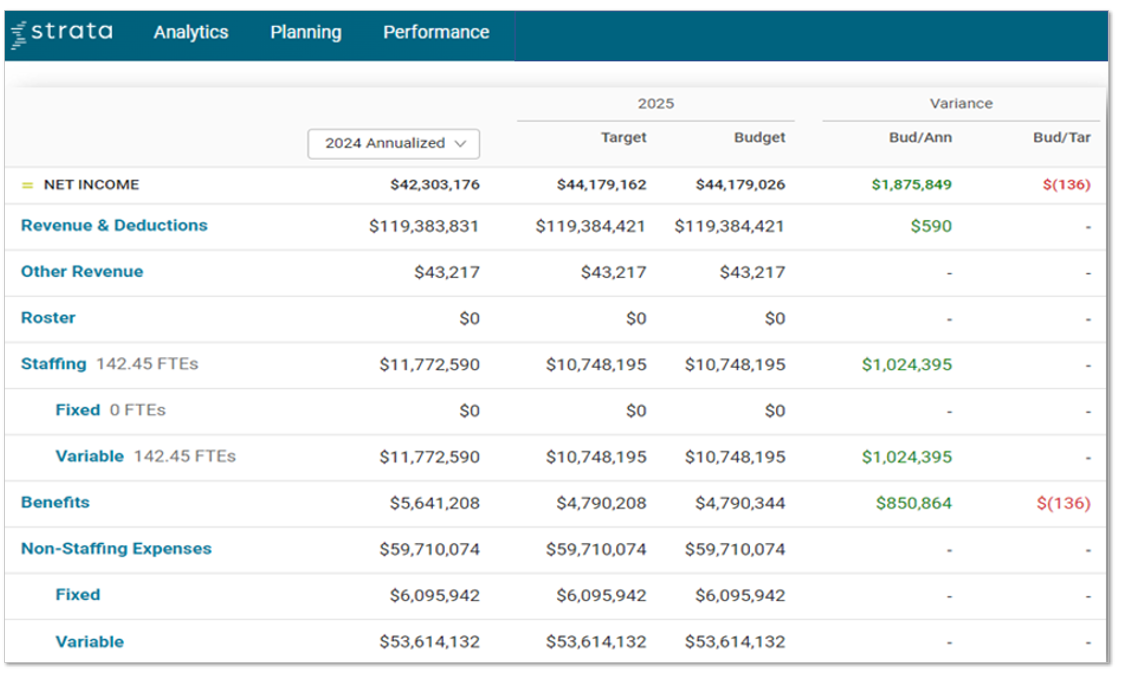

The Central Finance Team will collect existing and historical annualized data to create a starting point for the budget in Strata.

Next, our department managers will be presented with the initial budget for review. They will look for any inconsistencies, verify that the material is correct and make any necessary adjustments with their director before giving approval.

- Managers will receive an email notification from the Central Finance Team when the initial budget is ready for review in Strata.

- Managers can start by reviewing the initial data that the finance leaders have provided.

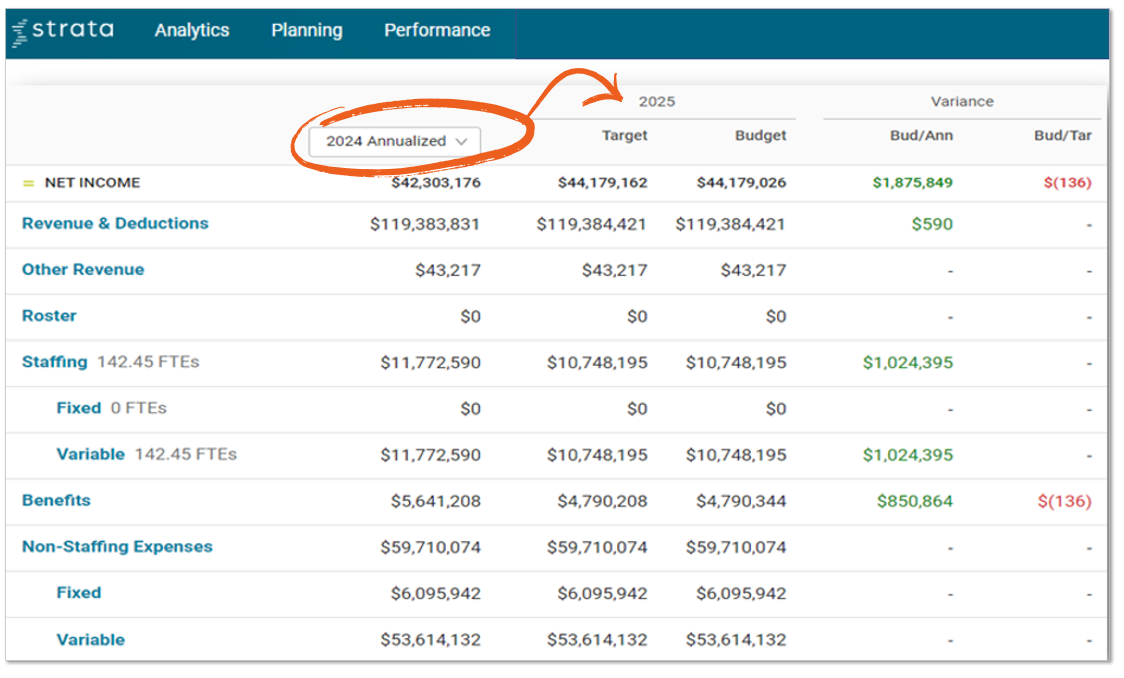

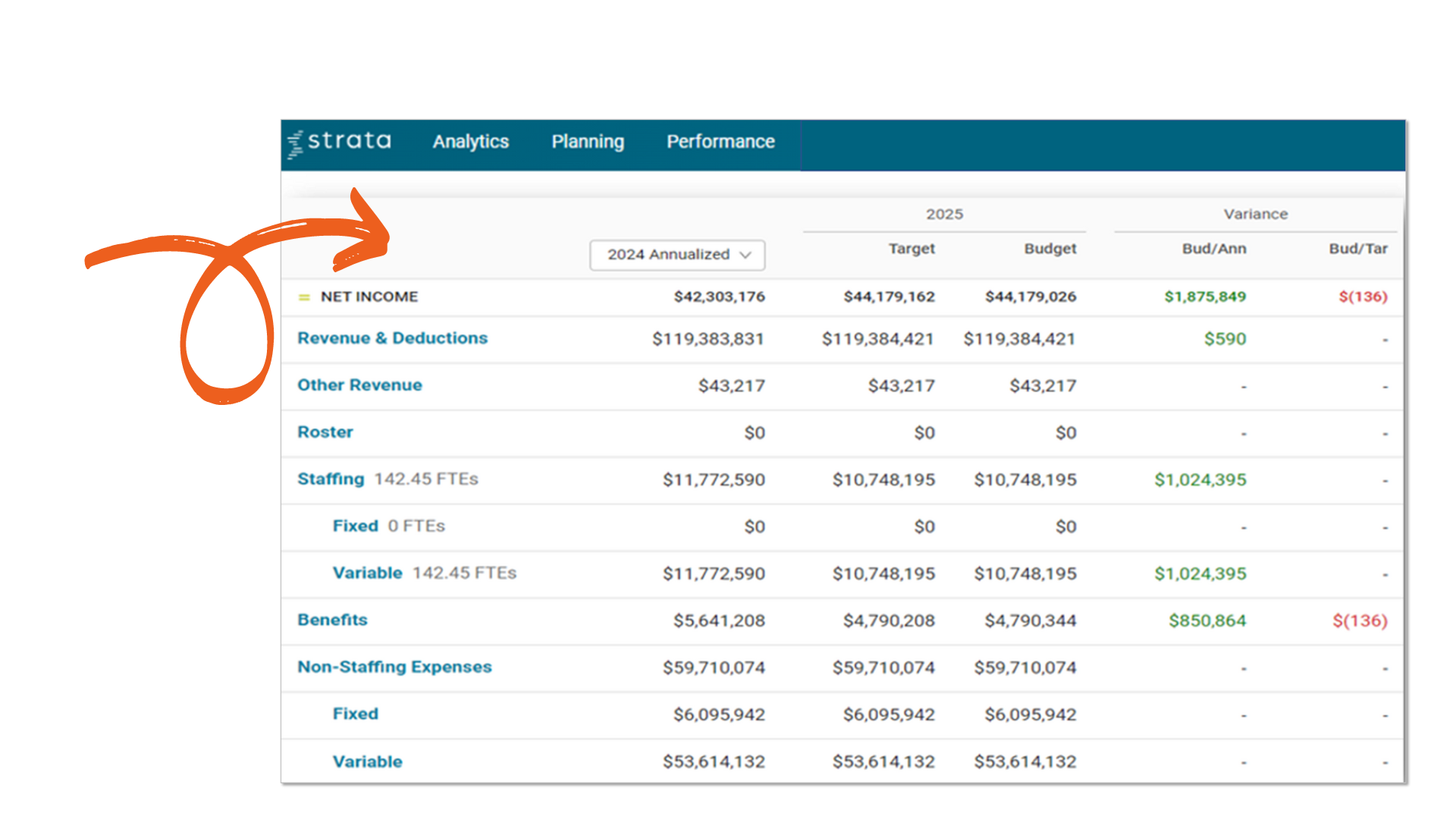

- Managers should compare the '2024 Annualized' column data to the 2025 'Target' and 'Budget' columns listed.

- 2024 Annualized: Average performance statistics from FY24, for reference

- Target: Goal statistic, per our Financial Action Plan

- Budget: Chosen statistic per your average performance and goal

- If things look accurate, managers can submit the budget for review. If things don’t look accurate, if adjustments are needed, it is time to connect with a director and a Central Finance team member.

- Managers will continue this comparison and review process for other applicable data sources:

- Statistics: This is for departments that generate revenue and/or track volumes like units of service (e.g. clinical care and EVS).

- Revenue: This is for departments that generate revenue (e.g. clinical care).

- Staffing: This is for both the departments that generate revenue and those that do not. This is usually the number one expense of most departments.

- Expenses: This is for both the departments that generate revenue and those that do not. This will include general ledger expenses.

Managers will review the budget again, once global assumptions are included. Global assumption drivers, based upon real-time market data, may impact the initial budget and require adjustments.

Global assumptions include:

-

Expense inflation

-

Price increases

-

Contractual rates

-

Bad debt and charity care

-

Annual increases

-

Depreciation

-

Benefits and PTO

Finance leaders will then review the submitted budget with managers and directors, and make any final adjustments, if necessary.

Finally, the executive leaders will collect and review budgets from across the organization. They will meet with leaders as necessary to understand the adjustments and budgets as set, before holding formal budget presentations.

What’s important to know

Our goal in Central Finance is to make your life easier. Through the Strata One Plan technology, most of the hard work is done for you. The Central Finance Team populates numbers based on both current and historical data before making projections for the next fiscal year.

We’re relying on your knowledge to help us fill in the gaps. Tell us if any of our data is off and help us review and identify any inconsistencies in your department’s budget. Early detection of these variations will save everyone involved time and energy down the line.

The annual budget may be our primary focus right now, but these financial tools can benefit you year-round. They can help you build a deeper understanding of your department’s long-term financial health. Familiarizing yourself with your department’s monthly fluctuations can help you spot errors and identify trends over time.

We’re here to help

Our role in Central Finance is to streamline the budgeting process for you. We’re here to help by providing a simple, step-by-step guide to build your budget. Our financial leaders are here to assist you, answer any questions and help you share your information with leadership.

Ultimately, we recognize that you are the expert in your area. You can identify variances in your budget that our corporate or leadership teams may not fully understand. When it comes to the financial health of your department, you can give us more than just a bottom line – you can tell us the whole story.

Join one of our upcoming Budget Labs at the HSEB Computer Lab

Budget Labs are a designated hour, open to anyone with budget questions or for anyone who would like help completing their budget. No prior appointment required.

-

Tuesday March 5, 2:30 – 3:30

-

Thursday March 14, 9:00 – 10:00

-

Wednesday March 20, 9:00 – 10:00

-

Monday March 25, 2:30 – 3:30

Casey Moore

Robert Dickson

Navigating budgets and finance can be a daily responsibility for managers, which is not always an easy task. Finance experts Casey Moore and Robert Dickson share the importance of and best practices for Management Reporting and how it can help you become a better leader.

Understanding financial reports is crucial for leaders making informed decisions for their teams and departments. Finance leaders Clint Reid, Casey Moore, and Robert Dickson walk us through some of the most common reports that leaders can utilize in operations and strategy.

Dr. Kyle Bradford Jones is back, this time with baseball analogies. Team success means having a team of contributors instead of one MVP. Jones writes that specific factors—positivity and team identity—are critical to nurturing a successful team.